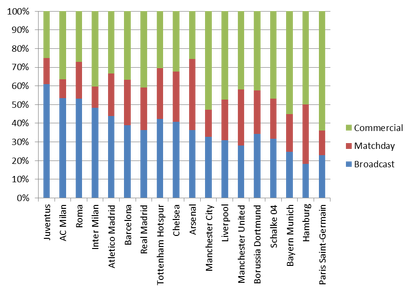

Regular readers of this blog will be familiar with posts I have written on sports broadcasting. There is a dedicated tab to the topic here. A common theme that runs through these is the ability of suppliers (broadcasters) to extract an economic profit from those seeking the product, often by virtue of the monopoly they hold in the market.

If anecdotal evidence is anything to go by, the past 5-7 days has seen an dramatic shift in power from supplier to consumer. Subscription sports channels throughout Europe, North America and elsewhere have seen their live content evaporate in a matter if days. The postponement of football, basketball, formula one, tennis, golf, and the list goes on, has surely resulted in a surge in cancellations of sports subscription channels.

From experience, cancelling these is difficult in normal times. One can only imagine what it is like now. It begs the question, how will the providers respond?

Could a reduction in price be on the cards? Or cancellation of the March/April charges?

A 2015 Ofcom Report which I wrote about here in 2016 identified "which specific sports and competitions within sports are important to subscribers". If these are no longer being provided to subscribers is it fair to charge full price, or even charge at all?

It might be time for sports channels to rethink their present strategy.

RSS Feed

RSS Feed