The question that motivated this piece, occurred to me last week, when I asked myself whether I was better off under the monopoly of Sky live Premier League games rather than the competition that now exists in the market.

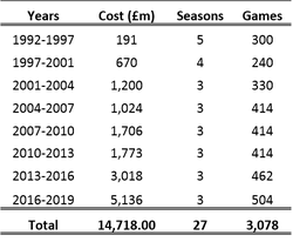

Those of us that have watched the English Premier League on a regular basis over the past two decades will be very familiar with the cost of subscription to access live games. When Sky Sports launched in 1992 it was not a foregone conclusion that pay-per-view would work for the newly formed English Premier League. Some argued that the channel may be left to carry the can having spent £191 million for exclusive broadcasting rights in the United Kingdom and Ireland until 1997. Table 1 below summaries the broadcasting rights sold by the Premier League to date.

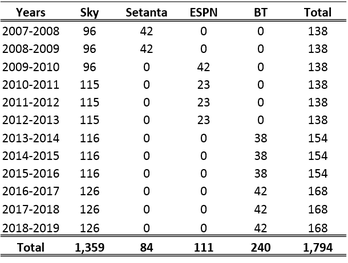

The emergence of Setanta from the 2007-2008 season also brought an end to Premiership Plus or Prem Plus as it had been know prior to 2004. Launched in 2001, this Sky owned channel screened 40 pay-per-view matches per season from the Premier League between August 2001 and May 2004, and a further 50 per season between August 2004 and May 2007. All 270 matches were sold on a game-by-game basis and involved an additional fee, on top of Sky Sports subscription.

In late June 2009, rumours of problems at Setanta Sports became public after the company failed to make a payment of £30m to the Premier League for broadcasting rights. American sports broadcaster ESPN stepped in and took over the two Setanta Sports owned packages for the 2009-2010 season. These packages contained a total of 46 matches that were available for the 2009–10 season. The new broadcasting deal from 2010-2013 saw ESPN’s roll reduced to just one package or 23 games as Sky had managed to wrestle back five of the six packages.

This is when Sky Sports subscribers arguably had their best days. Gone were the days of additional costs of Prem Plus matches and Setanta Sports subscriptions charge. All live Premier League games were now available under one subscription charge as ESPN came as part of the package. This was not to last however. In August 2013 British Telecom (BT) entered the market, screening 38 live games per season until the end of the 2015-2016 season. Table 2 below summarises the number of live games shown since more than one broadcaster existed.

The arrival of 'competition' in the form of BT Sport, who competed for the right to buy a section of the market, has resulted in a second monopoly. Assuming a cost of €25 a month for BT Sport, the season cost of both channels is €600 for this season, with a charge per game of €3.90. That's an increase of €1.36 per game. Both the overall cost and cost per game have increased; a strange scenario where competition in the market is actually making the consumer worse off.

However, Irish EPL viewers are slightly luckier and have an even greater incentive to subscribe to BT Sport as matches are shown on Setanta Ireland and include a live 3pm Saturday game, which is not broadcast in Great Britain due to a restriction on Saturday afternoon television screening of live football (and not included in the table above). This means roughly an additional 30 games per season, bringing the cost per game to around €3.25, still an increase on the Sky/ESPN days.

While Sky continue to be the main player in the market it will be interesting to see how their battle with BT Sport plays out. The most recent deal of £5.136 billion pounds is likely to be surpassed as both attempt to grow market share. The winners in all of this are of course the clubs and players.

One has to wonder though if such growth is sustainable. Does this have all the hallmarks of a bubble? Being Irish we have a keener eye than most when it comes to spotting bubbles in light of our recent past. Only time will tell, but there is nothing like a hard lesson to make you learn. As C.S. Lewis once said "Experience is the most brutal of teachers. But you learn, my God do you learn".

Thanks to John, David, Adam, Cormac, John E and others for their thoughts on this.

RSS Feed

RSS Feed