A girl on a trapeze wire, dancing animals, iridescent sparklers and wondrous pyrotechnics; welcome to the greatest show on earth – Super Bowl XLIX. 114.4 million viewers tuned in across the globe to witness the showpiece event of the NFL season making it the most watched finale in history. The annual event, the jewel in the crown of the televised NFL calendar, but surrounded by a cluster of equally lucrative gems in terms of TV value, brought to air by a money-spinning TV deal between the NFL and the major players in American network broadcasting.

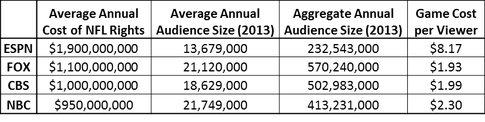

The new broadcast deal, which came into effect for the 2014 season and runs through to 2022, saw the NFL renew its broadcast packages with the major networks; Fox, NBC and CBS. Under the agreement each of the networks will hold the rights to three Super Bowls, while NBC can now boast the addition of the prime-time Thanksgiving game to its schedule. Though the minutiae of the deal have not been revealed, it is anticipated the three networks will pay on average $3bn per annum, an estimated 60% increase on the annual fee they currently pay. The fourth major player in the NFL’s TV deal is ESPN, who have seen the annual cost of their stake in the rights increase to $1.9bn per annum. ESPN’s greater cost for rights is reflective of their exclusive retention of the prime-time Monday Night Football package, the highest rated midweek show on American cable television.

These deals are independent of supplementary agreements the NFL holds with other media outlets, which nets them an additional $2bn in revenue every year. In advance of kick-off for the 2014 season, there was in the region of $7bn for NFL franchises to share between them from media money alone. This, before a season ticket went on release, merchandise hit the club shop, or a hot-dog and beer was consumed. Big money. High stakes. One of the principal reasons the networks are willing to invest so much in the NFL TV deals is because 97% of all sporting events are watched live.

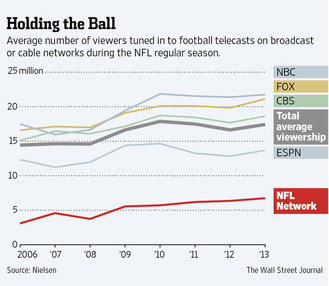

To appreciate the scale of the deals, and the audience the NFL reaches, Brad Adgate of Horizon Media has crunched the numbers from the raw data made available by the NFL and the networks up to and including the 2013 season. Here’s the math:

The exact figures for the individual networks, based on the 2013 data, would seem to indicate that NBC achieved the greater return for its investment, insofar as their average audience was greater than any other the other broadcasters. However, when the average audience per game and the number of games each network broadcasts are aggregated, Fox come out on top for the aggregate average audience for games in the 2013 season by virtue of audience share and the greater number of games broadcast. Under the new deal with the NFL, ESPN pays approximately twice as much the other networks, but if we examine the 2013 figures under the old agreement, ESPN was paying four times the rate of other networks when the aggregated audience figure was taken into account, as evidenced by the Horizon data below.

As alluded to, the viewership figures for live sporting events are immense, as are the costs associated with securing the rights. The broadcasters it seems are not afraid to speculate in order to accumulate, and accumulate they certainly do, with subscription fees for packages sold to cable networks promptly passed on to consumers. The NFL on TV doesn't come cheap, viewers should know, they’re paying for it.

Pádraig MacConsaidín holds a BSc Government degree from University College Cork and is the Department of Government, Richard Haslam - Graduate of the Year 2014.

RSS Feed

RSS Feed