In their latest popular book ‘Phishing for Phools: The Economics of Manipulation and Deception’, George Akerlof and Robert Shiller provide an analysis of the economics of fraud. Akerlof’s lecture at Duke University provides an overview of the theory and Shiller’s TEDxYale talk introduces the idea further. Both are worth watching. If you're stuck for time, Cass Sunstein offers a good review of the book which he titles Why Free Markets Make Fools of Us.

In short, Akerlof and Shiller claim that the free market acts as a double-edged sword. Despite the benefits, companies can take advantage of consumers and investors by using subtle forms of deception. ‘Phishing’ connotes big companies suckering customers (the ‘phools’) into buying or investing in dubious products. They argue that phools can be informational victims where facts are distorted or framed a certain way to hook us in. Equally, our emotions can cause us to make bad decisions – emotional arousal may result in a purchase that is not in our long term interest. Examples include the sale of questionable financial investments, cigarettes, and shoddy housing to name but a few.

Over the weekend I couldn’t help but think that gambling firms could take pride of place on this list of ‘phishermen’ after I viewed the array of betting products offered by the big gambling firms for football matches. While outright betting on football matches could be deemed fair, many big gambling firms clearly advertise what I would call ‘lemon bets’. These most often involve the consumer having to correctly predict multiple outcomes occurring. For instance, ‘scorecast betting’ involves estimating which player will be the first goal scorer of a match and what the correct score will be – an extremely challenging task. Importantly, these bets are frequently advertised as ‘specials’ in the front window of bookmaker shops in Ireland and the UK despite the extremely low probability of them occurring. Bookmakers also allow customers to make their own product online, where they can combine any goal scorer with a range of score outcomes. The price offered usually appears to be attractive although statistically the predicted outcome is highly unlikely to occur. The conjunction fallacy comes to mind.

The portfolio of bets on offer by all big gambling firms is complex and exhaustive. Scorecasts are just one such example where, in my view, consumers can be ‘phished for a phool’. In Akerlof and Shiller’s scheme it will be likely that all big gambling companies will be forced to advertise these lemon bets to compete. A bad equilibrium will be the outcome.

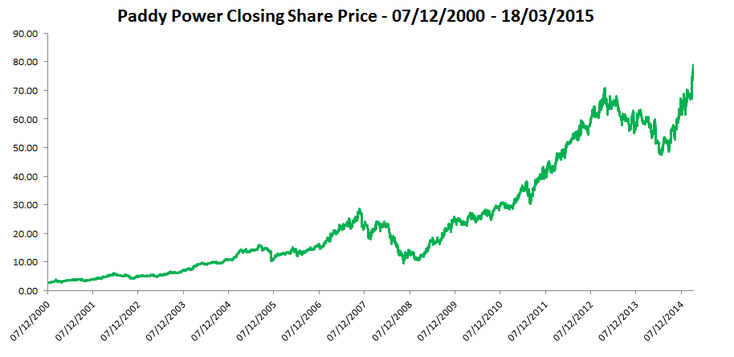

In Ireland there is a noticeable increase in advertising by gambling firms and their presence on social media has grown dramatically. My opinion would be that the growth of gambling has been aided by the dawn of smart technologies where the computer in our pockets allows us access to 24/7 gambling. The increasing market value of several gambling companies (see the Paddy Power closing share price below 2000-2015) most likely reflects a shift in demand for the product.

The question is whether informational campaigns are required to protect consumers further? Informational campaigns are provided for other addictive products such as alcohol and cigarettes in an attempt to prevent some form of behavioural market failure. And while our emotions and lack of information do not necessarily lead to a bad decision in terms of gambling perhaps customers need to be reminded that (i) the incentives that are at play - gambling companies are profit-making enterprises and (ii) the information asymmetry - crucially, the gambling firms have more information then me or you; they are statistical experts.

RSS Feed

RSS Feed